FINANCIAL SERVICES

AI Drastically Improves Credit Scoring for Consumers

Model development time reduced from months to weeks

Explainability helped meet regulatory requirements

The mission at Deserve is to democratize credit and provide fair access to credit to deserving but underserved populations. Over the years, Deserve has created equitable credit products, with the goal of leading young adults to financial independence. These products serve college students and young adults who otherwise would be ineligible to obtain credit under a traditional credit scoring system. Deserve looks at an applicant’s full financial picture, considering factors like how they manage money, along with records of on-time payments, to predict future credit potential. With H2O Driverless AI, Deserve is able to augment the traditional credit scoring models with additional datasets never considered before, deploy fast accurate scores all while improving trust in the machine learning (ML) models with the built-in explainability capabilities.

Challenges

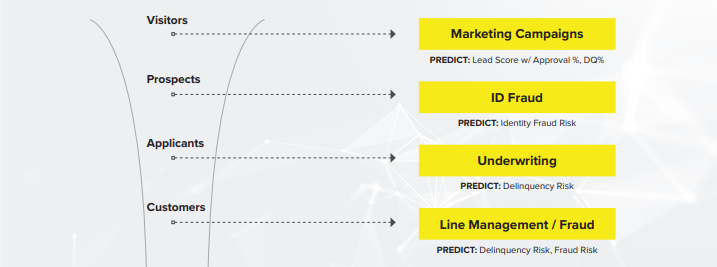

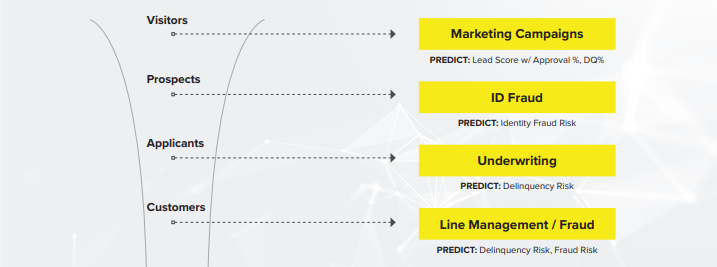

Deserve recently sought to develop three use-cases – a fraud model to help look for fraudulent activities and bad actors, a self-scoring model to put the underserved on a path to getting better scores with traditional credit scoring methods like FICO, and an underwriting model to help the underwriters evaluate creditworthiness using alternate sources of data.

These were all complex use-cases and they came with a whole slew of challenges: unlabeled data, dealing with opacity in machine learning tools, integrating alternative sources of data (e.g. 3rd party KYC data, fraud data providers, employment history) into the credit scoring pipeline, differently weighted data, and iterating the ML pipeline with different algorithms, to name a few.

By using H2O Driverless AI for automatic machine learning, we are able to more quickly deploy our proprietary algorithms that allow us to provide credit to sutdents and the underserved. H2O.ai helps us to save considerable time and scale quickly even with a smaller data science team.

Kaplesh Kapadia, CEO and Founder, Deserve

Solution

Powered by H2O Driverless AI, the data science team at Deserve partnered with H2O. ai to address these use-cases and took advantage of capabilities Driverless AI had to offer. Automatic feature engineering, model validation, hyperparameter tuning, model tuning, model selection and deployment, machine learning interpretability, and automatic pipeline generation for model scoring via APIs were instrumental in operationalizing the use-cases and deploying them in production.

They were able to formulate a new way to use the new signals of creditworthiness from the alternate sources of data. This has become one of the fundamental underpinnings of their business.

Results

The overall solution that the Deserve team has developed over the years offers a few key benefits to their business:

- The ML process at Deserve is more transparent than it has ever been. This has established the much-needed trust in AI and is critical in a regulated credit card industry.

- With Driverless AI, the Deserve data science team finds it easy to build new use-cases and deploy them into production faster. What used to take months now takes just a few weeks.

Key Use-Cases at Deserve

- Fraud detection model

- A new self-scoring model to build credit history

- Predict probability of default

More Customer Stories