The next wave of AI in banking is here, and it’s reshaping how institutions prevent fraud, streamline operations, and serve customers. We’re moving beyond simple prediction and into a new era of action. This is the world of agentic AI — technology that can integrate complex functions, automate tasks, and transform how banks fight financial crime and serve customers.

Think of a system that can navigate every technical layer of the bank, operate at high speed, and support experts with faster, more informed decision-making.

In a recent American Banker–hosted webinar, Annie Yan, VP and Head of Protect Product at TD Bank, and Sri Ambati, Founder and CEO of H2O.ai, discussed the bank's responsible, “human-first” approach to AI, how agentic AI is being leveraged to combat fraud, and what it takes for banks to accelerate their AI maturity.

Below are the 5 key takeaways from the webinar. You can view the full conversation here.

1. Expand AI from Prediction to Action

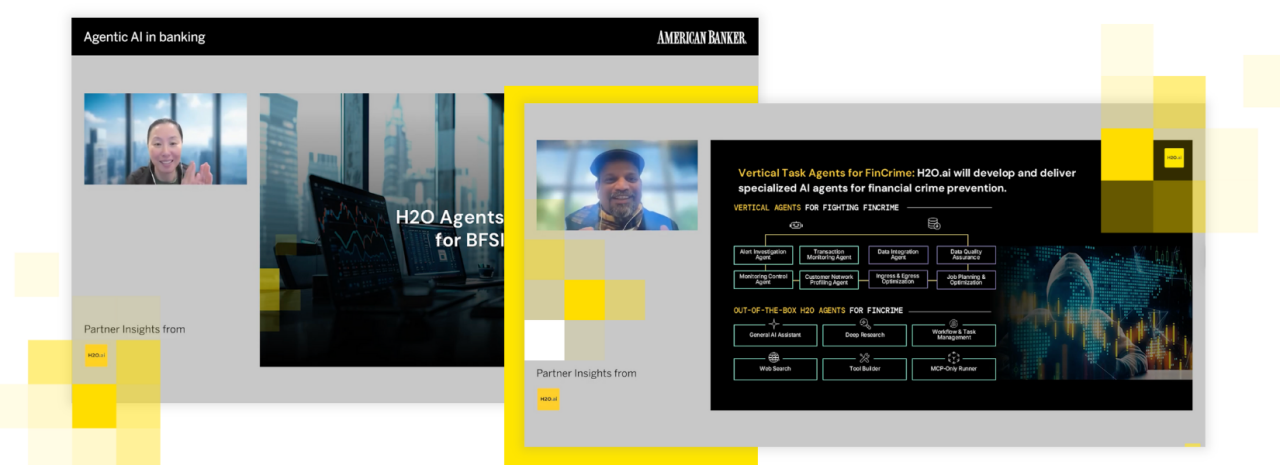

Traditional AI systems make predictions; agentic AI can take action and connect insights across multiple systems. This capability has led to major improvements in fraud prevention, with H2O.ai customers like Commonwealth Bank of Australia reducing scams by up to 70%. The technology can generate code, automate workflows, and connect previously siloed systems — all while maintaining necessary controls and governance.

Agentic AI isn’t the same as the generative AI assistants we’ve grown used to. Agents are far more capable, it’s a leap from prompt engineering to execution.

Sri Ambati, H2O.ai

2. Unify Fragmented Systems

One of the most significant advantages of agentic AI is its ability to unify fragmented banking systems. Traditional institutions often operate on technology built over decades, with data scattered across mainframes, cloud platforms, and new digital tools. Agentic AI acts as a universal translator, pulling data from multiple environments to create a single, human-readable view that analysts and investigators can act on in real time.

Agentic AI helps us unify systems built in different eras and languages, revealing patterns humans couldn’t connect before.

Annie Yan, TD Bank

This capability is particularly valuable in fraud detection and financial-crime prevention, where speed and completeness are essential.

3. Reduce Costs with Smaller, Fine-Tuned Models

While AI implementation may seem complex or expensive, many use cases don’t require massive language models. Smaller, fine-tuned models — often called small language models (SLMs) — can deliver faster, cheaper, and more secure performance for internal tasks like call-center support, data migration, and compliance reporting.

The biggest returns often come from automating routine back-office operations, freeing colleagues to focus on higher-value work and reducing errors that stem from manual processes.

4. Strengthen Decisions with a Human-First Approach

TD Bank’s approach shows that successful AI implementation doesn’t mean removing the human element — it means enhancing it. AI works behind the scenes to surface insights and support faster decisions, while human experts bring empathy, judgment, and context.

We’re in the business of protecting customers, and that’s our core responsibility. TD takes an approach that emphasizes empathy — supporting customers through difficult times.

Annie Yan, TD Bank

This “human-first” philosophy ensures that technology strengthens, rather than replaces, the trusted customer relationships at the heart of banking.

5. Partnership Is Critical for Success

The journey to AI maturity requires more than technology — it requires the right partnerships and frameworks. Research shows that most successful AI initiatives involve trusted partners who bring both technical expertise and a deep understanding of regulatory environments.

Strong collaboration enables banks to move faster while ensuring their models remain transparent, compliant, and auditable. As Ambati noted during the discussion, success often comes from “combining speed, responsibility, and partnership — agentic AI, when done right, brings all three together.”

The Path Forward: Implementing Agentic AI in Banking

The conversation between TD Bank and H2O.ai made one thing clear: agentic AI represents a transformative opportunity for the financial sector. Success depends on a thoughtful approach — one that balances innovation with responsibility, automation with human oversight, and efficiency with trust.

By embracing agentic AI strategically, banks can build stronger defenses against financial crime, streamline operations, and create better customer experiences — all while preserving the human connection that defines the industry.

GenAI Readiness Checklist

Is your bank ready to move from experimentation to execution? Use this quick self-check to assess your GenAI maturity:

- Data Foundation: Are your data sources unified, secure, and high-quality enough to train and deploy AI responsibly

- Governance Framework: Do you have policies for model validation, risk management, and human oversight?

- Use Case Alignment: Have you identified clear areas — such as fraud prevention or customer operations — where GenAI adds measurable value?

- Human-in-the-Loop: Are colleagues trained and empowered to use AI tools effectively?

- Partner Ecosystem: Do you have trusted technology partners to accelerate your journey while maintaining compliance?

If you answered “yes” to three or more, your organization may be ready to take the next step in adopting agentic AI.