AI Agents for

Financial Services

H2O.ai delivers the world’s leading Agentic AI platform—combining Generative and Predictive AI to automate, accelerate, and de-risk banking operations from customer onboarding and loan underwriting to fraud prevention and compliance reporting in regulated financial environments.

Why Leading Banks Choose H2O.ai

Transforming

Fraud Prevention:

Australia’s largest bank cuts scam losses by 70% using real-time GenAI from H2O.ai

30%

Fraud Reduction

70%

Scam Reduction

“Every decision we make for our customers—and we make millions every day—we’re making those decisions 100% better using H2O.ai than with previous models.”

Dr. Andrew McMullan, Chief Data & Analytics Officer

Commonwealth Bank of Australia

AI Agents Transforming Every Corner of Banking

Core Banking

Modernize Core Banking with AI Agents

From onboarding to treasury operations, AI agents accelerate workflows across retail, commercial, and wealth management.

- Automate SME onboarding and loan servicing

- Optimize portfolios and client segmentation

- Enable real-time forecasting and cross-border payments

Protect

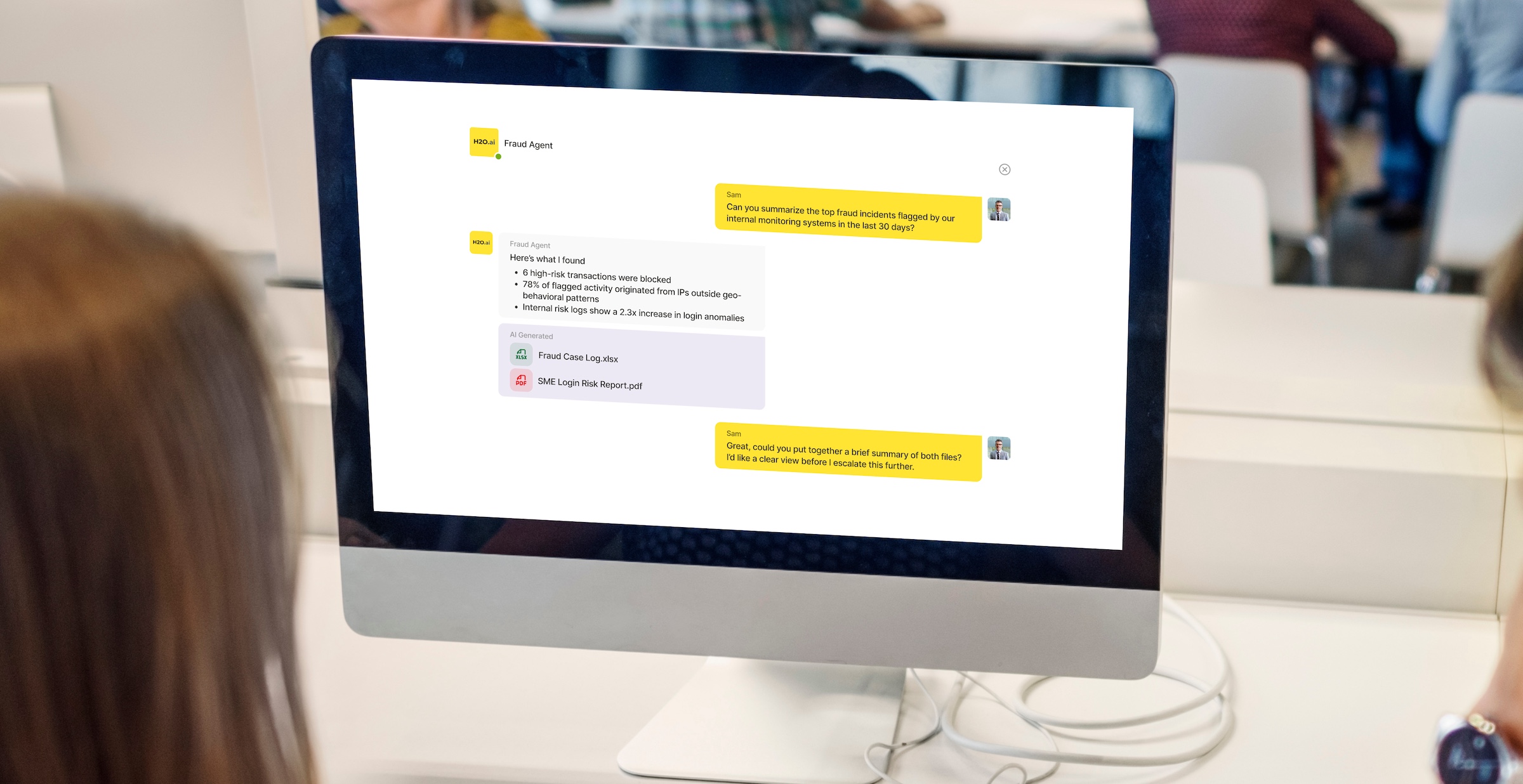

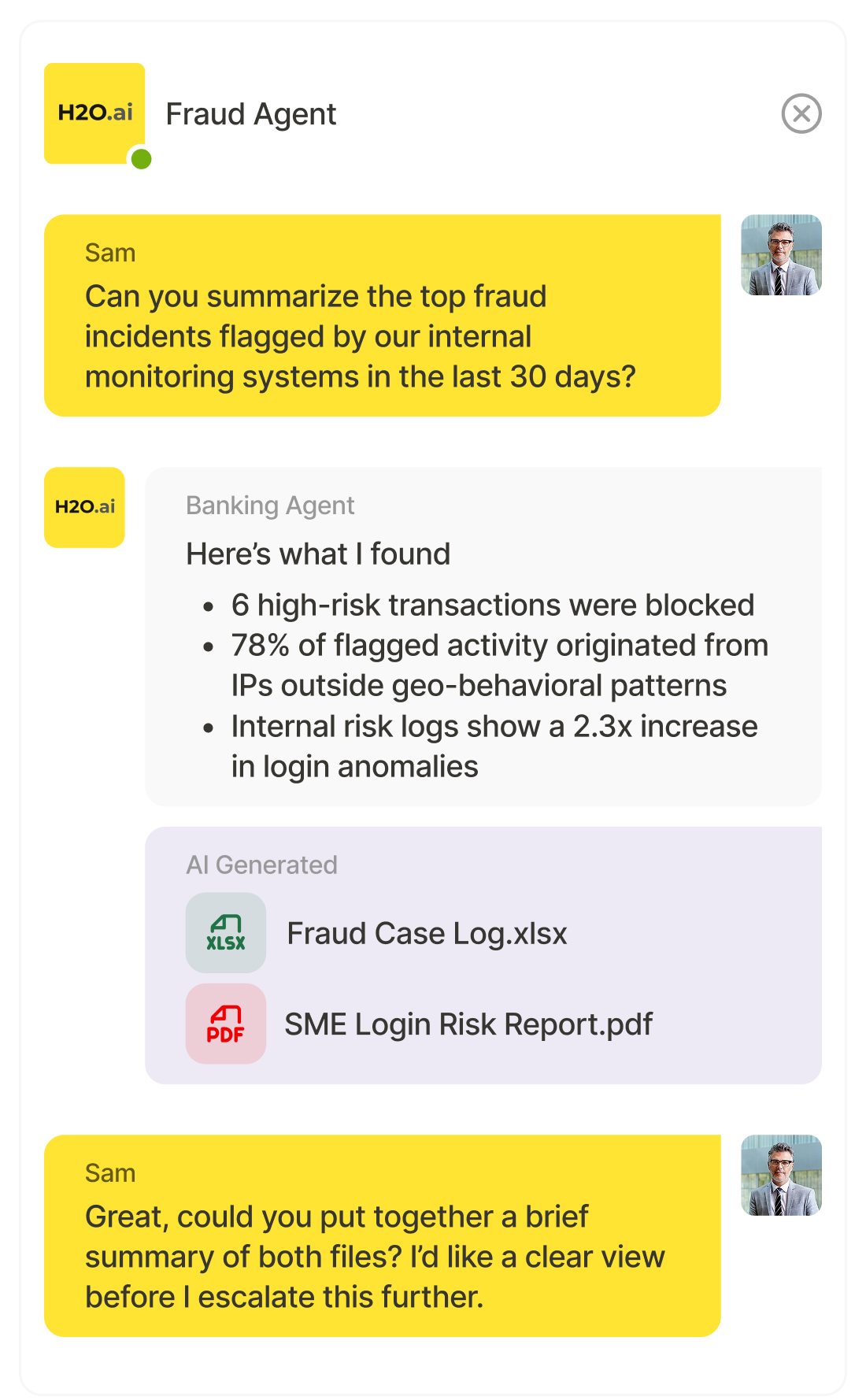

Proactive Protection, Autonomous Defence

AI agents detect fraud, prevent data loss, and enforce Zero Trust—before threats become breaches.

- Block fraud and synthetic identities in real time

- Detect insider threats and data exfiltration

- Automate patching and phishing detection

Customer

Personalized Engagement at Scale

AI agents adapt every interaction—from campaigns to customer service—based on behavior, sentiment, and value.

- Real-time personalization across channels

- Automate campaigns and loyalty programs

- Enhance retention with context-aware interactions

Enterprise

AI-Powered Decisions Across the Enterprise

From forecasting to IT automation, agents unlock insights and orchestrate workflows across the organization.

- AI-driven forecasting and capital planning

- Stress testing and climate risk modeling

- Data pipeline and DevOps automation

Support

Autonomous Support with a Human Touch

Resolve 80% of service tasks autonomously—while agents assist your teams with smarter insights and faster response.

- Automate password resets, disputes, payment matching

- Anticipate and resolve issues before they escalate

- Integrate chat, email, and voice with live agent support

Explore AI Solutions for Banking

Automate compliance, accelerate lending, and gain real-time insights with H2O.ai. Our AI assistants streamline KYC, credit risk, and reporting—improving accuracy and customer experience.