Artificial Intelligence Is Transforming Fraud Management

Read the guide to learn about the twelve critical questions you should ask when evaluating AI / ML platforms.

Volume & time related requirements, combined with high regulation levels, require a different approach to AI than other industries. Use our Executive guide to evaluate AI platforms that meet the unique business & regulatory needs of financial services. In the guide you’ll learn to:

- Perform “whole” AI offer evaluations that go beyond the technology.

- Assess architectural implications for ongoing innovation in a very fast-moving industry against TCO.

- Understand how platforms increase your teams’ productivity & collaboration across the entire AI lifecycle with AutoML & MLOps, dramatically improving your time-to-market in the most dynamic market conditions.

- Learn about platform capabilities implications for your bottom line & the criticality of AI explainability and model fairness and more.

Read our executive guide to learn about the twelve critical questions you should ask when evaluating AI and machine learning platforms.

Get your complimentary copy

Overview

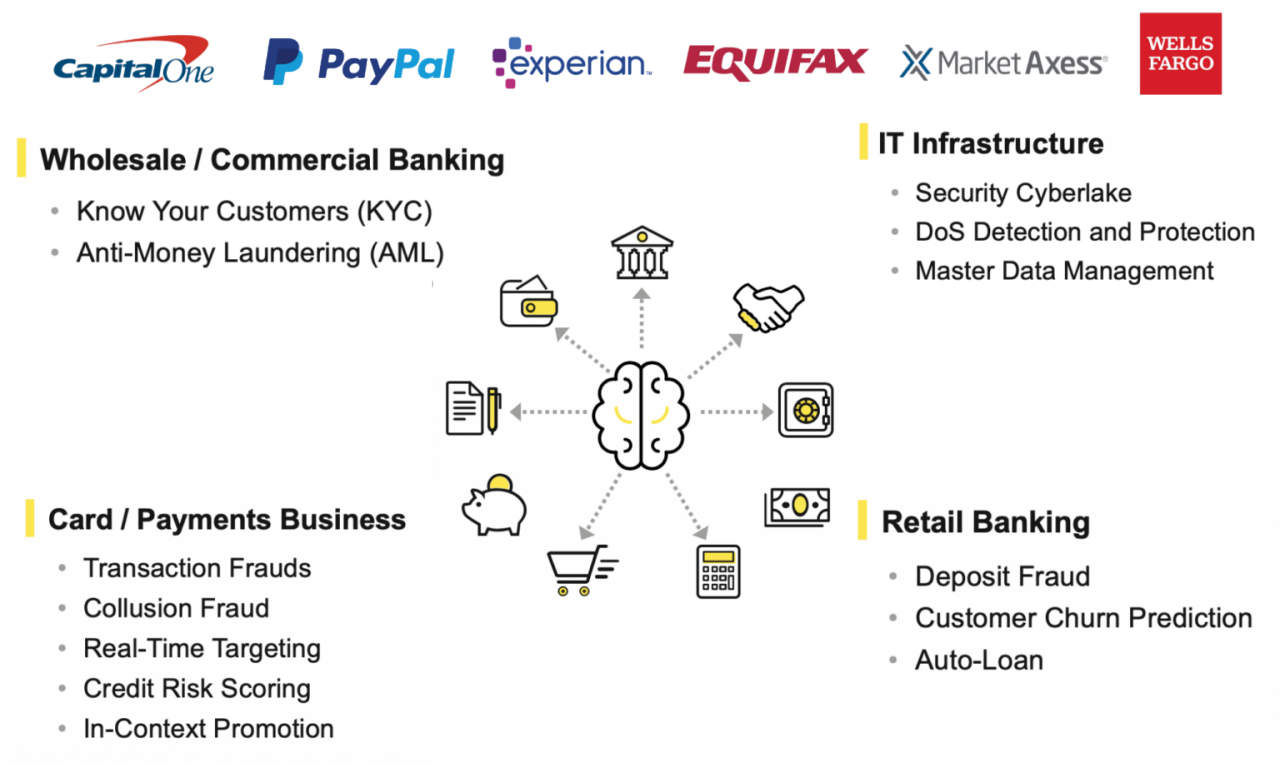

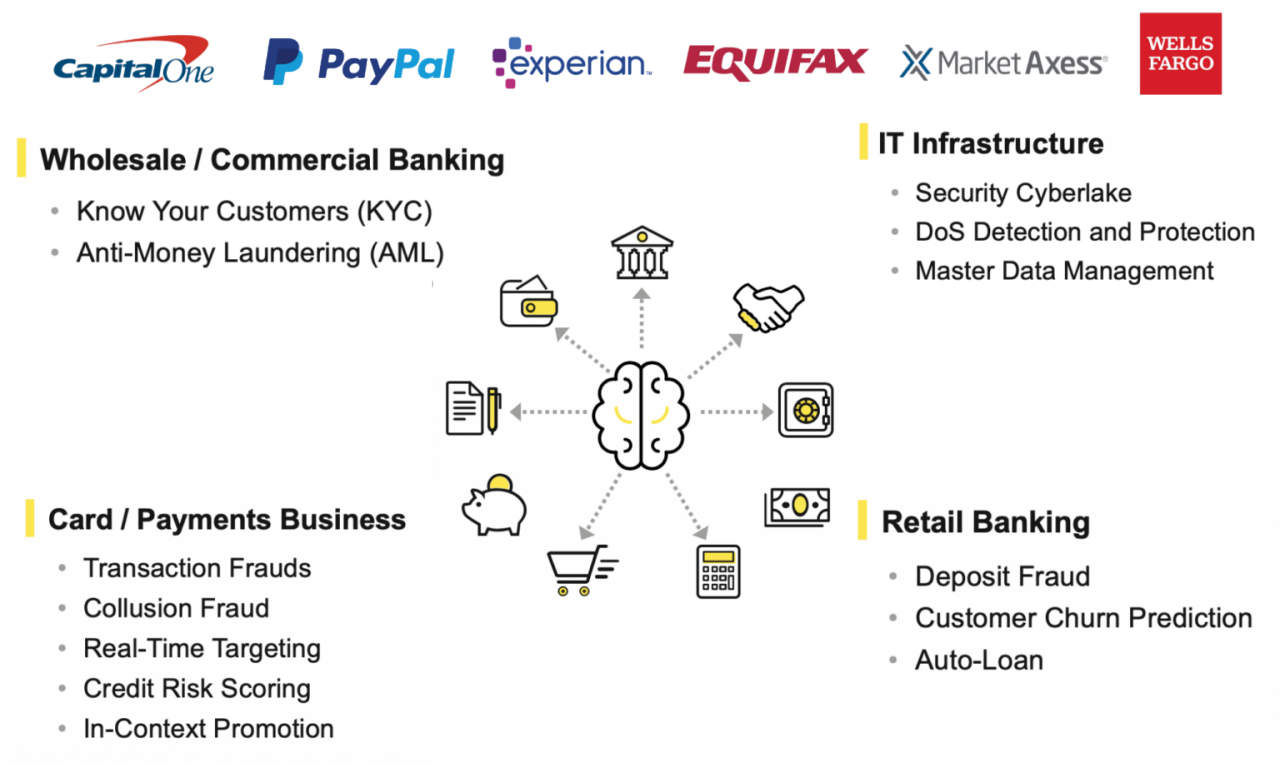

AI Transformation in Financial Services

In financial services the competition for customer share of wallet is intense with firms looking for every advantage in marketing while fighting fraud, money laundering and other issues. Companies that are making extensive use of AI are reaping the benefits of increased customer satisfaction and loyalty, decreased fraud, and reduced regulatory penalties which adds to their bottom line.

H2O.ai Use-Cases and Customers

Personalizing Credit Decisions with AI

Credit Risk Scoring

AI is a great solution for credit scoring using more data to provide an individualized credit score based on factors including current income, employment opportunity, recent credit history, and ability to earn in addition to older credit history. This more granular and individualized approach allows banks and credit card companies the ability to more accurately assess each borrower and allows them to provide credit to people who would have been denied under the scorecard system including people with income potential such as new college graduates or temporary foreign nationals. AI can also adapt to new problems, like credit card churners, who might have a high credit score, but are not likely to be profitable for the card issuer. AI can also satisfy regulatory requirements to provide reason codes for credit decisions that explain the key factors in credit decisions.

Stopping Crime with AI.

Anti-Money Laundering

AI, especially time series modeling, is particularly good at looking at series of complex transactions and finding anomalies. Anti-money laundering using machine learning techniques can find suspicious transactions and networks of transactions. These transactions are flagged for investigation and can be scored as high, medium or low priority so that the investigator can prioritize their efforts. The AI can also provide reason codes for the decision to flag the transaction. These reason code tell the investigator where they might look to uncover the issues and help to streamline the investigative process. AI can also learn from the investigators as they review and clear suspicious transactions and automatically reinforce the AI model’s understanding to avoid patterns that don’t lead to laundered money.

Understanding the dynamics of your customer interaction with AI

Know Your Customer/Client (KYC)

AI is an ideal technology for finding anomalous patterns and identifying areas of risk especially where there are a large number of items of different types that need to be reviewed and potentially correlated. Machine learning can be used to perform analysis of transactions and can look for indicators of suspicious behavior including transactions with dubious jurisdictions, suspicious companies or known parties. AI can also offer better insights into transactions through analysis of both structured and unstructured data. Natural Language Processing (NLP) techniques allow AI systems to search through communications to find additional signal including extracting metadata, identifying people or companies referenced, and categorizing the intent or purpose of the communication. All of these can help pinpoint suspicious transactions and help investigators as they investigate transactions.

Stopping Fraud in its Tracks with AI

Fraud Detection

AI can be used to analyze large volumes of transactions to find fraud patterns and then use those patterns to identify fraud as it happens in real-time. When fraud is suspected, AI models can be used to reject transactions outright or flag transactions for investigation and can even score the likelihood of fraud, so investigators can prioritize their work on the most promising cases. The AI model can also provide reason codes for the decision to flag the transaction. These reason codes tell the investigator where they might look to uncover the issues and help to streamline the investigative process. AI can also learn from the investigators as they review and clear suspicious transactions and automatically reinforce the AI model’s understanding to avoid patterns that don’t lead to fraudulent activities.

Finding Network Anomalies Faster with AI

Anomaly Detection

AI systems have been proven successful at detecting anomalies in transaction volume data. This time series process looks at expected data volumes based on historical patterns. Upper and lower boundaries are also predicted based on volume variation. This system is then used to compare real-time transaction value to expected volume. This real-time system allows network administrators to be notified when transactions start to spike above or fall below these boundaries so they can take action before an outage in service.

- credit

- antimoney

- kyc

- fraud

- anomoly

AI Helps Retain Valuable Banking Customers

Customer Churn Prediction

AI is a great solution for customer churn prediction as the problem involves complex data over time and interactions between different customer behaviors that can be difficult for people to identify. AI can look at a variety of data, including new data sources, and at relatively complex interactions between behaviors and compared to individual history to determine risk. AI can also be used to recommend the best offer that will most likely retain a valuable customer. In addition, AI can identify the reasons why a customer is at risk and allow financial institution to act against those areas for the individual customer and more globally.

Customer Stories Beating Fraud

Agus Sudjianto

EVP, Head of Corporate Model Risk, Wells Fargo

"Managing machine learning model risk is of the utmost importance in heavily regulated industries such as finance; in particular, to manage potential risks due to bias/fairness, conceptual soundness, implementation, and model change control"

The automation of the data science process reduced time and costs. And time is money. So, you can do more with the same amount of time. It's possible to deliver more value to the business, develop more use cases and focus the data science effort in the use case instead of development tasks.”

Ruben Diaz, Data Scientist, Vision Banco, Vision Banco

Rafa Garcia-Navarro

Co-Founder, CEO, and Chief Data Scientist , Ducit.ai

"When it comes to developing artificial intelligence products the deployment is where most platforms fall short and with H2O we've got the mojo implementation that essentially simplifies that to the point of being a java object that you incorporate to your platform. That's fantastic!"