AI in Insurance: Resolution Life's AI Journey with Rajesh Malla

Rajesh Malla , Head of Data Engineering – Data Platforms COE at Resolution Life insurance takes the stage at H2O World Sydney 2022 to discuss AI transformation within the insurance industry. Resolution Life is the largest life insurer in Australasia. Malla discusses the use of H2O Driverless AI to predict claim triage and other insurance AI use cases.

Who is Resolution Life?

I would like to discuss who we are to start with before I open up with the business case as well as our H2O journey. So we are the largest life insurer in Australasia. We manage about $27 billion of assets within Australasia. And we are part of a larger group called Resolution Life Group, which was founded in 2003. So, we operate across various continents as you can see. And our focus is to become a number one insurer across the globe by 2024. We are customer focused and a data-driven organization. So we would like to place all our decisions on data, and our focus is to get a right outcome, on humanitarian grounds, to our customers.

So today I’m going to talk about our journey with H2O. We recently started our journey with H2O about six months ago. And I’m going to discuss a business case that we have implemented H2O on and the benefits that we see today.

What problems are Resolution Life facing?

The business, as an organization and as the largest insurer, has paid approximately $1.1 billion in claims since 2019. The claims processing is largest and most complex in processing, which has its own problems, right? When a claim is lodged, we would like to assess the claim at the right time and provide a customer with the right outcome. So there are quite a few problem statements in assessing a claim. All our case managers are really working hard for a right outcome for our customer. Then again, because of the complex nature of the claims processing, they may need to look at historical data that is well and beyond their limits to understand the claims, understand the customer claims, understand the demographic claims, 360 degrees of a claim that has been submitted and whatnot.

So, there are quite a few complexities that we have listed on that. So that could result in not a right outcome for our customer. So we were looking at how to solve this issue and how to reduce our capital as well, because when we spend more time on processing a claim, that means it’s an expense to the organization, as well as not a right outcome for our client. We want our customers to be paid as quickly as possible and return to work for them to be successful in their life.

So our journey with H2O, as I mentioned, started six months ago. So before processing any of our claims, there are multiple steps before we process a claim, right?

Using H2O to segment insurance claims

The first step is to identify the segment of that particular claim. That means, is it an easy claim for us to move forward? Do I really need to spend any time on it? Or is it a complex claim where we really need to talk to our customers to understand their situation? Was there a claim made before? Is it an extension to the claim? The segmentation of the claim makes a critical part of the claims journey.

So what we have done is using H2O, we have implemented a claims triage model. What it does is eventually it segments out the claim. Previously when a claim was submitted, a claims manager needed to be assigned to the claim, open up the claim, look into the claim manually, spend about a day or two, or a week in some cases, to identify the segment of that particular claim before we can start processing the claim. So we made a big leap from there.

By implementing Driverless AI , now within 15 seconds the claim is actually launched, we can segment the claim into a bucket. That means we know the outcome of the claim within 15 seconds since the claim has been launched. And this is possible through H2O Driverless AI. What does it mean? It means a lot, right? It reduces the capital. As I said, that means profit to the organization and the right outcome for our customers.

Snowflake implementation on Azure and H2O

How we have implemented it: We use state-of-the-art technology at Resolution Life. We are in an organization where our entire platform is on cloud. So we don’t have any on-premises systems. We are a fully cloud organization and we are running on Snowflake, Azure, and H2O, some of the state-of-the-art technologies.

Soon after a claim is submitted through our claims application, an API gets triggered onto our Snowflake environment, and a module model is actually deployed. A module H2O model is actually deployed onto our Snowflake environment, where the model is constantly running on the Snowflake environment, giving a predictive outcome within 15 seconds. The outcome is sent back across to CMS, which is our Claims Management Solution, and also the outcome is actually stored in our container storage like Blob Storage where we can use it for our future purposes.

So how do we handle H2O? So, as you guys know, H2O is heavy on development and light on Productionisation. So that means all the development is done outside, training the model, making sure the model is good. All that is done outside and once the model is ready, we deploy the model across onto the Snowflake environment to utilize the compute power of Snowflake.

How H2O is more accurate than in-house claims models

I would like to show you this quite interesting slide. Maybe Sri will like this slide as well.

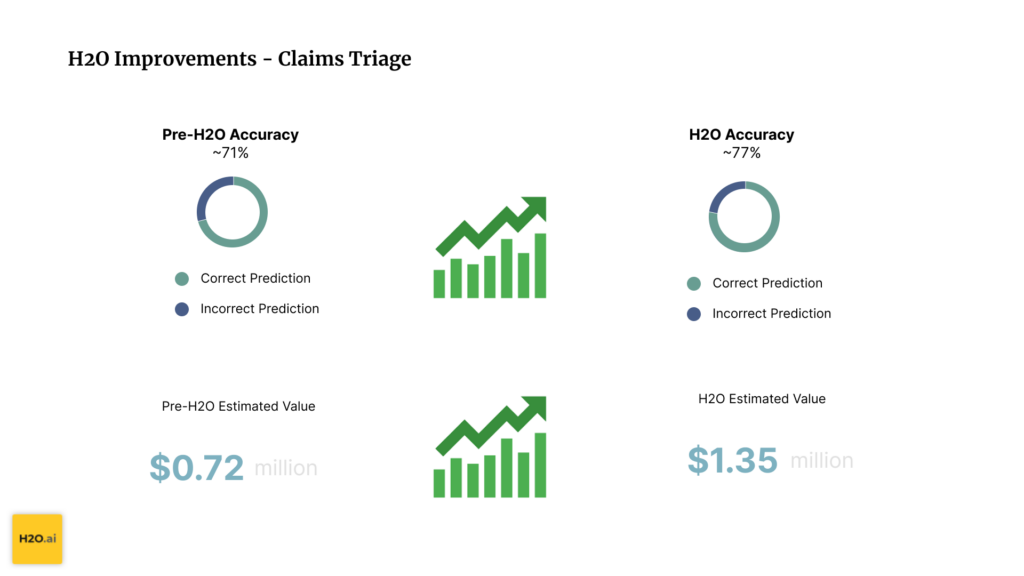

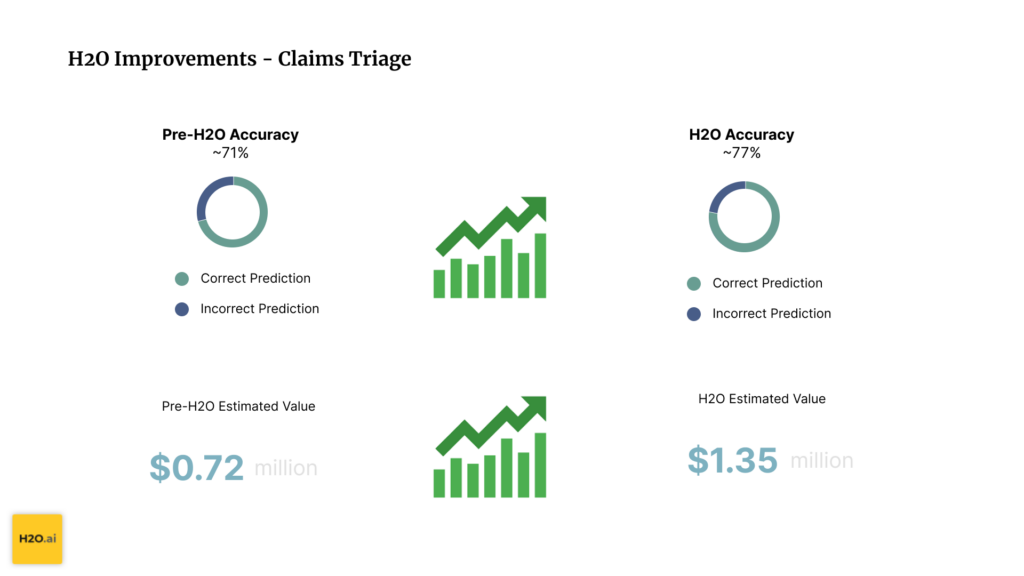

We were using this claims triage model in-house build previously before we got across onto H2O. We spent quite a bit of our time and the accuracy pre-H2O was 71%, where when we moved across onto H2O, the straight accuracy was 77%. That means 77% of our claims we are able to identify. We were able to segment them correctly. So that’s one of the biggest improvements, that’s about a 6% improvement there.

And then the estimated values, guys, don’t quote me on these values, these are just there as indicator numbers. These numbers can go anywhere from, if there are $3 million there. The benefit that you see is $6 million. So it just talks about the ratio of the benefit that we are getting.

So previously, all the in-house build, if it is giving us a value of $720K, soon after we’ve implemented H2O, it is $1.35 million. So that number is there, just to show you the ratio, one is two.

The most important thing, which is not in the slide, which I actually wanted to talk about, is the time taken to implement this.

H2O is 4x more efficient than in-house models

The time taken to implement this particular model in-house versus H2O is 1:4, so 1 H2O is 4 in-house models. So we need to have our own data scientists working on it, right? Where H2O is going to give us quite a few models for us to choose and predict from.

Benefits we achieved by implementing H2O

So what are the benefits that as an organization we achieved by implementing such a model? That 15 seconds outcome, the right utilization of our case managers, reducing the resources and focusing on where we actually need to focus on our business. That’s the right outcome for our organization.

- Performance:

- Claim prediction is completed in ~15 seconds providing near real-time prediction to the claim at the time of lodgement itself

- This ensures that the case manager is provided with the prediction when he starts a claim processing

- Accurate RTW time prediction provides:

- Case managers dedicate more time to customers and claims that need attention

- Case managers do not have to infer the outcome of claims manually

- Customers on short-term claims get paid out sooner

- Customers that will benefit from case manager support would be given more focus for assistance

Future Implementation of H2O in Call Centers

So, with this implementation, we are not going to stop here. We are looking at quite a few implementations going forward, and that will be based on the prioritization of the organization.

One of the interesting use cases, which could be relevant to every other organization, is that call center, right? We would like to use H2O to assess the right call reason. So we get, as of today, over 40% of our calls are through self-service, but still 60% of the calls that we get are answered by the call center people. So we manage more than 1.1 million customers. That means quite a large volume of calls that we manage.

Due to some restrictions, a customer may call for various different reasons. There could be a primary reason, there could be a secondary reason. Or the secondary reason could be more problematic rather than the primary reason for them. Because of these applications, the way that they are built, we can only capture one particular reason for the call. So we are not able to understand or identify where the emphasis should be going forward in order to bring our customer service levels up.

So what we are trying to look at is, in the future, we are looking at H2O to really understand our cues, the call generation, why is a customer calling us and what is the predominant reason for a customer to call? And based on that, we can improve our business, right?

The other thing which is also not in this pack, which is very close to my heart, is the product library where we are, at the moment, looking at Hydrogen Torch and assessing it. So, the plan for us is to build a product library that contains the information about the product.

Using H2O to Understand Product Disclosure Statements

The insurance business is a complex business as we know, right? Even twins living in the same household may not get the same product, right? Your premium will be slightly different.

So that means individual customers are having individual products. All those products are actually embedded in the product disclosure statements. So a product disclosure statement is a 30-page long statement. What is a product in relation to claim? What is a product in relation to finance? What does the product mean for an organization? It’s very difficult for us. There is quite a hierarchy for a product.

What we are looking at going forward using H2O is to identify that product library, and using Hydrogen Torch or going forward, we would like to build that capability within our organization that’s not there in this pack, but that’s something that we are working on, which is forecasted to be in Q1 2023, which starts from January.

Additional Use Cases for H2O

The other important use case that we are trying to look at is extending H2O over and beyond income production claims. We would like to extend it to the other parts of our claims business. We would also look at extending it towards the marketing for campaigns and whatnot. In our finance space and also for our actuarial, right? In predominantly actuarial, H2O may play a key role, within our actuarial analytics going forward.